Ever since I created Masculine Development, I’ve been a huge advocate of investing in the stock market…and it isn’t hard to see why.

When a kid like me could triple his money in just a few months, meanwhile professional Wall Street brokers were taking home measly gains of 5-8% per year, it’s hard to not be a proponent of investing in the stock market.

Over the past several years, however, there’s been a new and revolutionary type of market that’s emerged, known as “cryptocurrencies.” This encompasses things such as Bitcoin, Ethereum, and Litecoin—all digital currencies.

…and I’m not bragging when I say that my profits from trading cryptocurrencies like Bitcoin have absolutely dwarfed the profits I made from buying stocks. Now, rather than tripling my money in a few months, I can do it in a few weeks. Here’s why.

Bitcoin: A Primer

A couple of months ago I wrote a pretty detailed post entitled “The Definitive Guide to Investing in Bitcoin,” so if you haven’t read it I highly recommend that you start there. It’s packed with information on the basics of cryptocurrencies, Bitcoin mining, day trading, value investing, technical analysis, and more.

For those of you looking for a quick primer, however—here goes. Bitcoin is a totally decentralized, self-regulating algorithm which will eliminate the need for central banks, credit cards, bank loans, and national currencies. In short, it is nothing short of revolutionary.

That being said, it certainly does have its downfalls, but I’m not too concerned. The internet could easily be tanked by a single hacker back in the early 1990’s, and it took minutes, sometimes hours, just to connect to a website. Now? It’s more secure than ever, and you can stream 1080p videos straight onto your smartphone.

Bitcoin will continue to grow and evolve, just as every other great man-made invention does…and for those of you who get left in the dust, I feel sorry. Bitcoin has already created dozens, if not hundreds of millionaires, thanks to its exponential explosion in value. I’m well on my way to becoming one of them.

There’s a few key reasons why I believe trading bitcoin is better than investing in stocks, however. There’s not as much competition, it’s a solid asset from a value investing perspective, there’s no high speed trading algorithms just yet, and more. Here’s why I think it’s better to invest in Bitcoin than to buy stocks.

#1 – Very Few Professional Traders

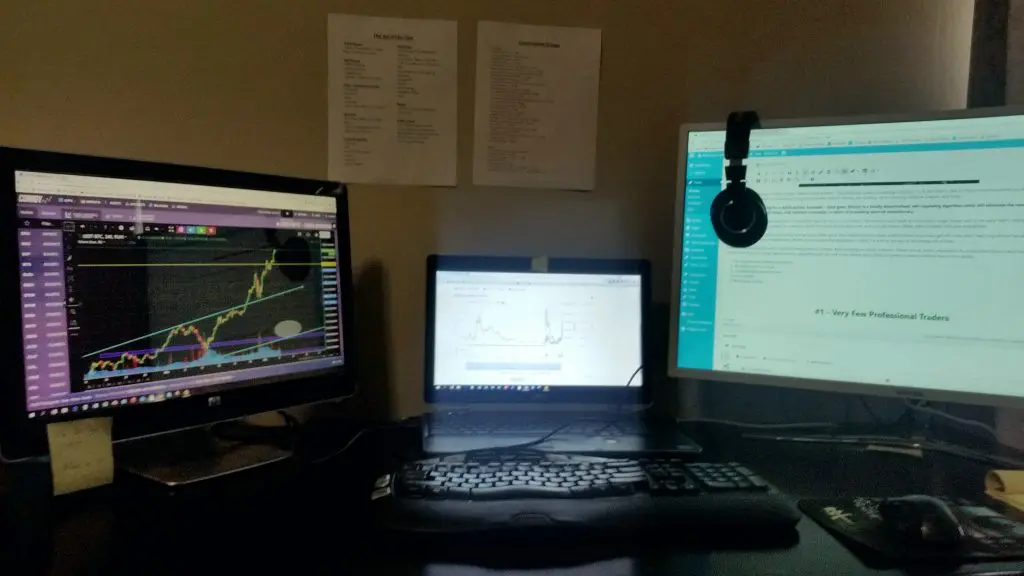

The other day I had a reader ask me about my tri-monitor setup. It’s certainly not something you see everyday, and he wanted to know if there was any particular reason that I had three computers all hooked up to function as one unit. Do you want to know why I have a tri-monitor setup?

Part of it is so that I’m highly productive with blogging and other pursuits, but a major reason is so that I can trade cryptocurrencies like a professional. If I can watch three times as many charts as an amateur trader, who do you think has the advantage? I do. This brings me to a major reason why I think trading Bitcoin is far better than trading stocks.

Since Bitcoin is such a relatively new market, there’s very few professional traders involved. That means less experts, which translates to less competition and more profit for you.

When I used to trade the stock market, I was regularly going up against all manner of competition. From high speed trading algorithms to “Wolf of Wall Street” types who had insider information and 10 computer screens to monitor stocks, I was going up against the best.

With Bitcoin however, do you know who I’m going up against? I’m trading against some 15-year-old kid who uses Bitcoin to buy drugs, a couple of college flunkies who trade Bitcoin in their spare time, and maybe a few good traders. There’s far less competition.

#2 – No Banks Are Involved Yet

Banks are some of the most corrupt institutions on the entire planet. From tanking entire economies, to funding countless wars, to having ties with deceitful politicians, to charging ridiculous interest rates in places where they have a monopoly, it’s hard to deny that banks are pretty evil.

Of course, there’s still some benefits to having banks, but that being said they’re still one of the most corrupt institutions on the planet. I saw this firsthand when I was trading the stock market—there was this candlestick pattern that would crop up every now and then, and I knew it meant bad news.

Many investment banks use a strategy called a “pump and dump,” where they leverage the fact that they have billions of dollars to invest, and use it to manipulate the market. First, they’ll place a ton of orders which will drive the price up. They’ll ride that for a few months, and then BOOM sell everything. They’ll cash out with the big bucks, and all the amateur investors who held onto their stocks will be broke.

With Bitcoin, this is virtually impossible—although banks are trying to get in on the action, they won’t be able to fully adapt for another 5-10 years. It takes time for giant institutions to evolve and grow, but you and me? We can start trading Bitcoin professionally with a few clicks and a bit of knowledge.

Another downfall of investment banks is that they use something called “high frequency trading algorithms,” where they basically take advantage of the market using computer programs and blazing fast internet connections. While I don’t really think this is unethical, it certainly poses a major disadvantage to average traders.

There are no high speed trading algorithms in Bitcoin yet, however—and if there are, they’re few and far between, owned by script kiddies and hackers, rather than billionaire bankers who invest ungodly amounts of money into rigging the system. Bitcoin is a fresh new market, ready to be traded without bank involvement.

#3 – Bitcoin is Highly Volatile

When you’re trading over short to medium periods of time, you typically want high volatility. This just means that the price changes very rapidly—so it could be at $10,000 per Bitcoin one day, and then go up a whopping $2,000 or 20% the next day. This is good for traders, because traders seize opportunities like this.

Since the cryptocurrency market is still in its’ infancy stages, there’s a lot of growing to be done, a lot of hype to be met, and a lot of new traders to come on board. This all equates to increased volatility, sometimes of 50% in a single day, which is a trader’s absolute wet dream.

Back when I used to trade e-mini futures on a regular basis, it was a good day if I could net a 3-5% increase. The average stock experiences volatility of maybe 1-3% per day, meaning that they don’t go up or down very much in short time frames. Bitcoin on the other hand commonly goes down or up by 10-15% per day.

This means that traders can better leverage their funds to create wealth. If you buy Bitcoin at a certain price, predicting that it will go up, and it goes up 15% in a single day, you’ve just made twice as much as the average Wall Street trader makes in a YEAR. Most stocks only go up or down by 1% a day.

“But Jon, isn’t volatility bad? That means my investment could go down very quickly,” I can hear someone ask. Yes, it does mean that—you can make money on the way down however, which is known as shorting. I won’t delve too deep into this, but for now just know that volatility is good.

You can’t make any money if your $10,000 investment goes up to $10,100 in a day, and then back down to $9,900 the next day. If you put that $10,000 in Bitcoin however, it could grow to $11,500 within a day. Greater risk, greater reward—but as point #5 will show, the risk is far less than you’d think.

#4 – No Barrier to Entry

When I used to trade the market on TDAmeritrade, they’d typically charge a $10 fee every time you bought or sold a stock. This means that if you’re a kid trying to invest $100 into the stock market, you’re already going to lose 20% of your investment literally just from buying and selling a stock.

This is why you need much higher capital to invest in the stock market, at least for day trading and swing trading. You can’t really even make a full time living by trading the market unless you have AT LEAST $10,000 to start with. This is how Bitcoin is changing the world, though.

With Bitcoin, they don’t charge you exorbitant fees like banks and stock brokers do—in fact, you can purchase $100 of Bitcoin right this second, and not only will you only be charged 3% by Coinbase, but they’ll also give you a free $10 worth of Bitcoin.

These lower trading fees allow virtually ANYONE to enter into the Bitcoin market, from a wealthy businessman who wants to buy $5 million worth of Bitcoin, to a kid in South America who only has a few hundred bucks to invest. The ramifications of this are absolutely massive.

Exchanges typically charge even less—with Poloniex for example, which is my recommended trading platform for men in the United States, I get charged something like .25%, as in a quarter of a percent. Compared to what TDAmeritrade used to charge me, this is absolutely incredible.

#5 – Bitcoin is Revolutionary

I know what you may be thinking. “Jon, this sounds great and all, but Bitcoin is just digital money. How do you know it’s not in a bubble? How do you know that it won’t crash down to 10% of its current value in just a few weeks?”

This is a great question. See, as I’ve covered before, there’s multiple types of trading—short term, medium term, and long term. I prefer to combine them, because if an investment looks good on all three fronts, it has massive potential to generate wealth for both me and the people I choose to give to.

Due to the fact that Bitcoin is fundamentally revolutionary, it is an extremely profitable long term investment. In other words, even if it goes down 30% in a single day, that doesn’t matter—because as John McAfee said, the long term picture is that Bitcoin is going up and up, baby.

Some have predicted that Bitcoin will hit $500,000 by 2020 and others claim it will hit over $1 million by the same year. Based off of my experience in the market, I don’t think this is too much of a stretch at all—Bitcoin has all of the fundamental components that make an investment extremely profitable:

- Still in its infancy stages

- Market capitalization is barely even scratching 1%

- The idea is new and world-changing

- It’s backed by something physical (processing power and electricity costs to mine it)

- Self-regulating (meaning it’s highly immune to corruption and bad leadership)

Mark my words, Bitcoin is going to change the world in absolutely incredible ways. It’s going to serve as a global currency which will unite the world’s economies, eliminate centralized banking, help fight censorship and drug laws, and enable third world countries to climb out of poverty. Invest while you still can.

Summary

In short, I’m convinced that Bitcoin is a far better investment than the stock market for a multitude of reasons. There’s far less competition, banks won’t be able to adapt for another decade or so, there’s no high speed algorithms to fight against, and the upside is virtually limitless.

Every single day, more and more men are becoming aware of the power of Bitcoin—it cannot be censored, it cannot be regulated, it cannot be controlled, and it cannot be fucking stopped. Whether you’re a multi-millionaire or a kid with a few bucks to invest, Bitcoin is the way of the future.

Bitcoin is enabling Julian Assange to continue exposing government corruption through WikiLeaks, despite the fact that multiple banks have tried to defund him. Bitcoin is enabling controversial writers and critics of culture to make a living, despite the fact that PayPal and other online payment processors have blacklisted them.

Most importantly however, Bitcoin is enabling average folks like you and me to escape from the 9-5 grind and live a life of wealth and prosperity. Bitcoin is enabling the average man to explode his wealth, to escape from the system, and to support whatever causes he wish, in complete and total anonymity.

Nice article! First I gained about 69k dollars. Then I lost it all.. Well I’m gonna try again soon 🙂

Coinbase takes 3 days to make a transaction. Jon, do you use anything that is instant? When it hit over the 20k mark I thought about selling but I didn’t because of the 3 day wait period.

Coinbase is typically instant, but they had some delays since they’ve been bombarded with new users. They’ve expanded something like 500% in the past year, and it’s only going up from here. They’re back to normal now, with transactions only taking 15-30 minutes (or less depending on the coin).

Thank you for this post John. I am 22 currently and planning on investing a few hundred bucks just to see how it goes. But I don’t think I will ever stop working 9-5(8-6 in my country) as an engineer because 1) It is my dream job. 2) It is a cushion if all my investments fail. I will be serving in the military starting at February for six months and after that I can start investing. I am a fan of your site Jon, keep slaying.

Thanks, brother. Might wanna wait a couple months until the bubble pops – it’s never a good idea to jump in when prices are at an all time high.

Bitcoin has been surging lately. With everyone buying like crazy do you think it’s going to crash again soon?

Yep. So what I’m doing is I have some long term holding which I won’t sell until Bitcoin hits $1 million. For my swing-trading funds however, I’ve cashed them out and will buy when Bitcoin dips. I’m guessing it will dip to about $10,000 to re-test that level.

So your gonna make a course on this?since this is so new and emerging is anyone qualified to really do this?also are you gonna cover like security storage ico blockhain liquidity and how to tell scam coins from worthwhile ones oh and taxes??

It is a relatively new market, but the same skills that I honed from trading the stock market also apply to cryptocurrencies. Yep, it’s going to cover everything 🙂

I’ll actually make a YouTube video about this pretty soon, subscribe to my channel. I’m going to start putting out a bunch of cryptocurrency stuff teaching guys how to trade 🙂

Testing testing testing