One of the most commonly asked questions I get is: “Jon—how do I get rich?” Well, to be honest, there’s no simple answer to that. There’s as many ways to get rich as there are to skin a cat, but in general, there’s a few rules every rich person follows.

I’ve been re-reading Rich Dad Poor Dad, which is one of the most widely popular books on personal finance ever written, for the very first time, and in this book, Robert Kiyosaki discusses 6 rules that you MUST follow if you want to get rich. Robert Kiyosaki, for those of you who don’t know, is a multi-millionaire real estate mogul…so I think he’s someone we should listen to.

According to him, getting rich really boils down to just 6 simple principles—if you integrate these rules into your life, and genuinely live by them, you will be wealthy beyond your wildest dreams.

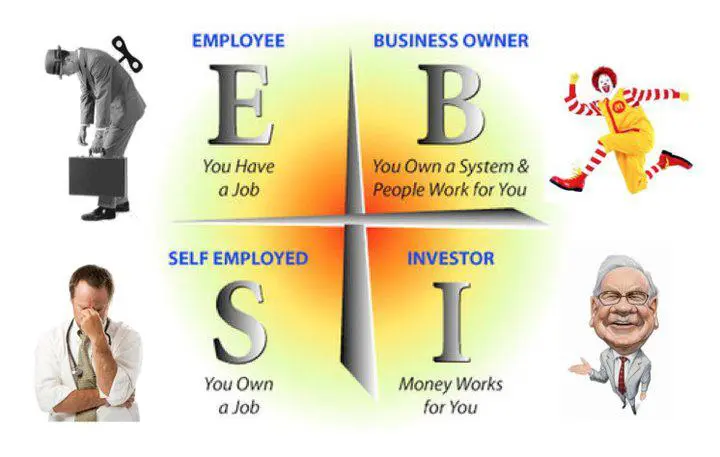

Principle #1 – Have Money Work For You

“The rich don’t work for their money.”

-Robert Kiyosaki, Rich Dad Poor Dad

Go look off of a bridge over a major highway sometime. Do you know what you’ll see? Thousands of worker bees stuck in bumper to bumper traffic, drudging along on their way to work. Seeing that shit literally makes me depressed. They don’t realize that you will NEVER get rich by working for money. You have to shift your paradigm and make money work for YOU.

“Why won’t you ever get rich from a job, Jon? Plenty of CEO’s and doctors are rich!” Wrong. They work 80 hours a week doing incredibly stressful work, and the second that they stop working, they won’t make any more money. And what’s even worse, is that their time is the limiting factor in how much they can make. They can’t earn any more than they can work. That isn’t true wealth. Do you know what true wealth is?

True wealth is when you don’t work a single minute for a whole year, and your business is still generating $15,000,000 a year.

Now, obviously having a 15 million dollar business is out of reach for most people (for now), so what’s the point of learning this principle? The point is that if you want to get rich, you have to make your money work for you. And you do this, by investing in assets, and limiting liabilities.

[thrive_leads id=’13220′]

Most people do the exact opposite, and then wonder why they’re broke—they buy dozens of liabilities (things that drain your bank account every month), and have ZERO ASSETS. Then, they shout: “It’s the 1%! They’re keeping me down, man!”

Bullshit. You’re just wasting your money. For those of you who don’t know, an asset is something that generates cash, while a liability is something that drains it.

Examples of liabilities:

- A car payment ($500/month)

- A house payment ($2,000/month)

- Random bullshit you don’t need ($500/month)

- Credit card bills ($100/month)

Do you see the common pattern here? Every month they all drain you of your income. Is it any wonder that most people are broke, when they accumulate these things like no tomorrow?

What you want to do, instead, is accumulate assets:

- Good real estate

- High quality stocks

- ETF’s

- Bonds

- Mutual funds

What do you think this will do for your wallet? It will make it WAY BIGGER, because instead of having to worry about “oh fuck, I need to make my car payment!” or “DAMN I forgot my credit card bill was due last Tuesday!” you can sit back and relax as your bank account grows by 30% each month.

I cannot over-emphasize how good you feel when you make money while you sleep. When I was still heavily involved in the stock market, after the market closed every day, I’d check it to see whether I’d made money or lost money. And more often than not, because I was smart with my investments, I was raking in a TON of money.

It felt fucking awesome knowing that while I was off doing other stuff, I just made $400 that day.

If you’re just starting off trying to accumulate assets, I highly recommend that you read my article on how I tripled my money with gold stocks. If you want to get rich, you MUST accumulate a ton of assets. There is no way around this.

Principle #2 – Live Below Your Means

“It’s not how much money you make, it’s how much money you keep.”

-Robert Kiyosaki, Rich Dad Poor Dad

If you want to get rich, you need to spend less than you make. It’s that simple. I’ve talked about living a minimalist lifestyle before, but you don’t even have to do THAT—just spend less than you earn, that’s all you have to do. Now, of course, this is WAY harder to actually do than it sounds.

In order to do this you need to cultivate discipline. You need to cut your credit cards in half, or just keep one for emergencies, and ONLY buy things that you can afford. Most people get stuck in the trap of buying things that they can’t afford, but by the time they realize it, they’re $75,000 in debt. This is how people get trapped in the rat race.

So the next time you’re considering buying a car, instead of shelling out $30,000 for a new one off the lot, consider spending $5,000 for a nice used car, and then maybe another $2,000 to fix it up and give it a new paint job. Boom. You just saved yourself $23,000. Instead of buying a whole house if you aren’t ready to settle down yet, find some badass roommates and split an apartment. You’ll easily save $1,000/month.

The point is that you need to not only EARN money, but you need to PROTECT it. Don’t just let it fly out the window.

“But Jon! What if I want nice things?” I can hear you ask. Dude, I want nice things, too. But do you know what? Let’s get rich in the first place. THEN, once we’re wealthy enough that we have $4,000 a day coming in, we can indulge a little bit. Until then, however, leverage all of your resources to help you get rich. Don’t spend a PENNY on luxury items until you’ve invested at least $10,000 in assets.

Principle #3 – Business vs. Jobs

“Mind your own business.”

-Robert Kiyosaki, Rich Dad Poor Dad

Recently I had a conversation with my chiropractor (I fucked up my spine training martial arts a while back), and he said something that I found very interesting. “Most people confuse having a job with having a business. When you look at me, and I own this entire practice by the way, even though I’m earning well into the six figures, this isn’t a business.”

“I still have to come here every day, or else my client base will drop and I’ll stop making money.” he said. “With a true business you make money whether you’re away or not.” I found this very insightful and am thankful for the wisdom that he gave me; I also find that it correlates perfectly with this lesson.

Don’t mistake your profession with your business. This is one of the most important caveats of the 10x rule.

People often think that if they 10x the amount of effort they put in, they’ll make 10x the amount of money… but this is ONLY true when you put that effort into your BUSINESS! Otherwise, you’re just making your boss really fucking rich, and not yourself.

A profession is just a job you work that gets you income. You will not get rich doing this. A business, however, is an ASSET. It makes money whether you’re sleeping, on vacation, or working out. It makes money all of the time. So many people get caught in the rat race, because they think that having a profession is the safe way to go. Interestingly enough, it is.

[thrive_leads id=’13220′]

I’m not going to lie—having a profession is a very safe, stable thing to do. But you’re not going to get rich from a profession. The only way to get rich is by being an entrepreneur. Yes, being an entrepreneur is WAY riskier, but the payoff is also WAY higher. If you’re smart, which I know you are if you’re a member of the Masculine Development community, you’ll more than likely be able to take smart risks.

This is the secret of the “new rich,” men who’ve gotten wealthy from the internet. They mind their own business.

They may have a profession and work a day job…at first. But every night when they come home, they’re building their business. They’re recording music for their new album, they’re writing blog posts, they’re doing online freelancing…they’re doing SOMETHING to further their business and get rich.

This is what you need to do if you want to become wealthy. Don’t just quit your day job if you need the money, but slowly start transitioning into your own business. Learn to work for yourself. If you want to get rich, you must work for yourself.

Principle #4 – Utilize Tax Breaks

“My rich dad just played the game smart, and he did it through corporations—the biggest secret of the rich.”

-Robert Kiyosaki, Rich Dad Poor Dad

Most men end up working a day job, and then they get taxed on what they earn. They then try to save that money and invest it, which gets taxed AGAIN. So in other words, they’re getting taxed twice. The rich don’t make this mistake; they utilize the power of corporations and LLC’s.

Corporations and LLC’s give you a SHIT ton of tax benefits—for example, when I had an LLC (long story, I’ll get to it later) EVERYTHING was a tax write off. Oh, I wanted to go treat my clients to dinner? That’s $50 that I’ll get paid back in taxes. I want to go on a retreat to Hawaii to talk business with some important investors? That’s a $10,000 tax return.

The biggest benefit of having a corporation is that you’re taxed AFTER your expenses (which includes the things I just listed). The laws in the U.S. are made to favor the rich, so you might as well use them to your advantage.

This is why Wall Street brokers can blow $50,000 in a weekend in Vegas on strippers and coke, but because they go with their clients, it’s a “tax write off.” And what’s more, is that if you own a corporation or an LLC, you get to pay all of your expenses BEFORE you’re taxed, which means you’ll be in a lower income bracket by the time you’re taxed, which equates to paying less in taxes.

Most men get taxed first (which puts them in a higher income bracket) and THEN they have to worry about paying for their expenses. If you expect to get rich, you MUST learn about the tax laws so that you can take advantage of them. “But what if I don’t have a business, Jon? How do I make an LLC?” You don’t. If you don’t have a business, RE-READ THE FIRST PRINCIPLE. You will not get rich without a business. Period.

I recommend you start an online based business, for four reasons:

- It’s cheap

- You can do it now

- It’s location independent

- You don’t need any experience

It can be anything. It can be a blog, like mine (yes, Masculine Development is legally registered as a business), or it can be an online consulting service. You can even learn how to sell eBooks online and start earning some nice side income (like me). Whatever it is, be sure to utilize the tax laws in both your country and your state (if you’re in the US). If you want to get rich, you must learn about tax laws—there is no way around this.

Principle #5 – Money is a Mirage

“The rich invent money.”

-Robert Kiyosaki, Rich Dad Poor Dad

Money is a very interesting thing—to one man, it’s his lifeline. To another, it’s his $500 baseball tickets. But to the rich, money is an illusion. The rich realize that money only has power, because we all agree to use it. Money is an imaginary concept; it’s just a bunch of ink on pieces of paper. It’s literally an illusion—albeit, a very powerful one.

Once you realize that money is an illusion, you’ll realize that you can create it. Money does in fact just come out of nowhere. “But Jon, how does money come out of nowhere?” you might ask. I’ll tell you.

Say that you decide to buy $10,000 worth of stock. Is it really worth anything? Not really. It’s worth what people say it’s worth. Whatever the buyers are willing to pay, that’s what it’s worth. So the next day, when a news story comes out about how the company you own stock in just had an unexpected 50% increase in revenue, what do you think will happen?

The stock will shoot through the fucking roof.

So in just one day, you could literally make $10,000 for doing nothing. So where did this money come from? Again—money is an illusion. You literally created money out of thin air by simply having something that others wanted more than they did yesterday. If you want to get rich, you must realize that money is an illusion.

If you buy a house for $50,000 and then flip it for $75,000 you literally just created money out of thin air. That money didn’t exist before; you literally just had something that someone else wanted, and because you were able to leverage your resources (buying the house at the right time, marketing it properly, etc.) you just created an excess of $25,000.

This is the big secret if you want to get rich: money doesn’t exist. Once you fully internalize that money is in fact a made up concept, you’ll start seeing ALL KINDS of opportunities. All of that knowledge that you have? It isn’t worth anything, is it?

No, but if you write it all down and put it on amazon it could be a $150,000 eBook. That’s the difference between $0 and six figures—you taking action.

Money is literally created out of thin air; you just have to have the guts and a little bit of knowledge to do it.

Principle #6 – Invest in Education

“Work to learn—don’t work for money.”

-Robert Kiyosaki, Rich Dad Poor Dad

The second that you stop learning, you stagnate. Slowly, but surely, your brain will rot and you’ll find yourself unable to remember simple things. I’ve seen quite a lot of people get a little bit slower each year, a little bit dumber each year…and do you know what?

It’s 100% avoidable. All you have to do is educate yourself; this is why I talk so much about reading books filled with wisdom. It literally keeps you AWAKE over the years. It keeps you seeing reality in new ways, it builds new neurons in your brain, and it expands your world-view.

Reading books also helps you get rich, because the smarter you are, the better you’re able to see opportunities and seize them.

Do you think any average idiot could see a huge opportunity in the stock market or in real estate, and seize it? Fuck no. They might as well be rolling a dice on their financial future. When you’re smart, however—that’s when everything changes. Suddenly you can see the rules of the game, and you can learn how to play it better.

This is why the best investment you will ever make is investing in yourself. I put a large amount of my income towards attending seminars, taking online courses, reading books, and doing things that will expand my world view. I’m always be investing in myself.

In fact, one of the best investments I ever made was the Tai Lopez 67 steps course. It’s literally just $67, and has HOURS worth of video advice from a guy who’s done literally over $100 million in sales.

Whatever money you spend on a good education will be returned 100 fold. You can literally buy a $6 paperback book on amazon written by Sam Walton, which talks about how he started literally one of the world’s biggest, multi-billion dollar stores (Walmart). An entire LIFETIME of hustling, grinding, investing, and wisdom, written on his DEATH BED, is distilled down into a little paperback book that you can buy for 6 fucking dollars.

Do you know how much money you can make from the ideas hidden within that little book? I don’t, but I know it’s probably a massive amount. This is, BY FAR, the most important of the six points, so if you remember ANYTHING from this article, remember this:

The poor stop investing in education at a young age, but the rich continue to invest in their education over their whole lifetime.

If you want to get rich, you MUST invest in your education. Buy eBooks, paperback books, spend money going to seminars, buying courses; ALWAYS expand your mind and grow as a human being. The second that you stop learning is the second that you start dying.

Summary: How to Get Rich

Anybody can get rich, because it’s actually really simple. It boils down to a few core concepts; invest in assets (including your own mind), minimize expenditures, and learn tax laws. Anyone can get rich if they apply the right principles—and I’ve given you the right principles today.

I’d recommend re-reading the article a few times to really let these ideas sink in. If you enjoyed the article, consider buying the book for yourself to really cement the lessons into your mind. Remember: getting rich is a mindset more than anything.

As usual, if you guys have any questions, comments, or concerns, let me know. Either way, I hope you guys enjoyed the article—and, as always, I’ll see you next time.

There was one thing that Robert left out and that was Love. You’ve got to love your human family and not just use them to climb up, you’ve got to love others to build bridges were there are none, and you’ve got to love yourself enough to have faith to keep going, you’ve got to love your team even though they continue to fail, only the strength of the energy of love will get you through the tunnel of transformation and onto the other side of success. I love you all.

Some good points in here, but this one

“you can sit back and relax as your bank account grows by 30% each month.”

Is obviously bull.

Stock investments sound nice, but the knowledge of how to and chance of making a packet does not often come to most people.

I know he gets a lot of hate but I think Rich Dad, Poor Dad was a great book. It was one of the first financial books that I read and really enjoyed it. The biggest takeaway I had from it was the assets/liabilities concept and how most people spend their money on liabilities and not assets. Once that switch was made in my mind it has helped me tremendously in my quest to become financially independent from a job.

Also on a side note just got my copy of Prometheus Rising today peeked at in and looks really good, thanks for the rec.

Definitely – just this fundamental shift is extremely powerful. And awesome, that book was life-changing for me, hope you feel the same 🙂

Where are you in life now??

When do you typically get out of a stock? I have some investments that have done well but ended up being over valued and while I still made money it wasn’t nearly as much as it could have been. I also have a few that tanked and aren’t worth paying the trade fee to get rid of. Also, when do you put more money into a stock that’s doing well. Say you want to put more in but the price has risen since your original purchase, now buying more at a higher price will offset your profit, and going back to my original question (when to get out) you can end up fucking yourself if it’s overvalued at the time.

PS. Great website please post more stuff about generating income.

It’s more of an art than it is a science, tbh. It depends entirely on the stock, but usually it’s a combination of how certain I am that it will go up vs. go down.

That’s true, but you can also learn to invest when the stock goes through 1-4% dips, so your overall percentage gain is down, but you still gain more money.

Thanks! Will do 🙂

I would say that one of the most important attributes to any of these steps is discipline. Without discipline, you will not stay focused on lean living, learning, seizing opportunities, or stop bitching about the 1% and how we need to raid them and then kill each other over the scraps of industry.Why should you invest when you can just sleep in and order a pizza online? Discipline. Something that is severely lacking in today’s society, especially in the school system.

Agreed. Discipline is the foundation which every man needs to build his life upon.